Týmové úspěchy

Týmové úspěchy

Vítěz nejvyšší domácí soutěže: 1972/1973,

1986/1987, 1988/1989, 2004/2005 Pohár mistrů evropských zemí:

2. místo (1974/1975)

Vývoj názvu týmu

1923 – LTC Pardubice 1949 – Sokol Pardubice (sloučení LTC a Rapidu) 1950 – Slavia Pardubice 1953 – Dynamo Pardubice 1960 – Tesla Pardubice 1991 – HC (Hockey club) Pardubice 1995 – HC IB (Investiční banka) Pardubice 1997 – HC IPB (Investiční a poštovní banka)

Pardubice 2002 – HC ČSOB (Československá obchodní banka)

Pojišťovna Pardubice 2003 – HC Moeller Pardubice

Vyřazená čísla

5 – Jiří Dolana 10 – Jiří Šejba 13 – Vladimír Martinec 16 – Karel Mach 17 – Bohuslav Šťastný 20 – Vladimír Dvořáček 20 – Jiří Novák 21 – Milan Koďousek

Individuální úspěchy

Mistři světa

1949, Stockholm: Vladimír Kobranov 1972, Praha: Vladimír Martinec,

Josef Paleček,

Bohuslav Šťastný 1976, Katovice: Vladimír Martinec,

Bohuslav Šťastný, Jiří Novák 1977, Vídeň: Vladimír Martinec,

Jiří Novák 1985, Praha: František Musil, Jiří Šejba 1996, Vídeň: Michal Sýkora, Zdeněk Uher

(trenér) 1999, Lillehamer: Vladimír Martinec (trenér) 2000, Petrohrad: Michal Sýkora,

Vladimír Martinec (trenér) 2001, Hannover: Dušan Salfický,

Vladimír Martinec (trenér) 2005, Vídeň: Adam Svoboda, Aleš Hemský,

Petr Průcha

Olympijští vítězové

1998, Nagano: Dominik Hašek, Milan Hejduk,

Vladimír Martinec (trenér)

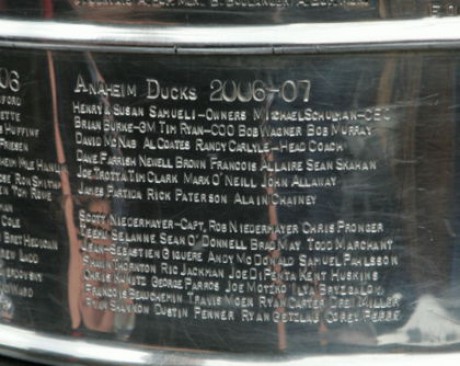

Vítězové Stanley Cupu

2001, Colorado Avalanche: Milan Hejduk 2002, Detroit Red Wings: Dominik Hašek

Vítězové Zlaté hokejky

1973: Vladimír Martinec (Tesla Pardubice) 1975: Vladimír Martinec (Tesla Pardubice) 1976: Vladimír Martinec (Tesla Pardubice) 1979: Vladimír Martinec (Dukla Jihlava,

Tesla Pardubice) 1987: Dominik Hašek (Tesla Pardubice) 1989: Dominik Hašek (Tesla Pardubice) 1990: Dominik Hašek (Tesla Pardubice) 1997: Dominik Hašek (Buffalo Sabres) 1998: Dominik Hašek (Buffalo Sabres) 2003: Milan Hejduk (Colorado Avalanche)

Členové klubu ligových kanonýrů

Jiří Dolana (Pardubice, Jihlava)

261 (228 + 33) Stanislav Prýl (Pardubice, Jihlava)

272 (223 + 49) Vladimír Martinec (Pardubice, Jihlava)

498 (343 + 155) Jiří Novák (Pardubice, Jihlava)

331 (255 + 76) Bohuslav Šťastný (Pardubice )

329 (256 + 73) Jiří Šejba (Pardubice, Jihlava)

260 (227 + 33) Ladislav Lubina (Pardubice, Jihlava)

362 (337 + 25) Richard Král (Pardubice, Třinec )

318 (317 + 1)

Ocenění jednotlivců; vítězové ligových trofejí

1964/1965: Zdeněk Špaček

– Nejlepší střelec 1972/1973: Vladimír Martinec

– Nejlepší nahrávač 1975/1976: Vladimír Martinec

– Nejlepší nahrávač 1978/1979: Vladimír Martinec

– Nejlepší střelec 1988/1989: Otakar Janecký

– Nejlepší nahrávač

Dominik Hašek

– Nejlepší brankář

Dominik Hašek

– Nejlepší hráč play off

Vladimír Martinec

– Nejlepší trenér 1989/1990: Dominik Hašek

– Nejlepší brankář 1990/1991: Ladislav Lubina

– Nejlepší střelec 1993/1994: Richard Král

– Nejlepší střelec

Radovan Biegl

– Nejlepší brankář

Milan Hejduk

– Nejlepší nováček

Marek Sýkora

– Nejlepší trenér 1996/1997: Miloš Říha

– Nejlepší trenér 1997/1998: Tomáš Martinec

– Nejužitečnější hráč 2000/2001: Petr Sýkora

– Nejlepší střelec

Petr Sýkora

– Nejproduktivnější hráč

Aleš Píša

– nejlepší obránce 2002/2003: Ladislav Lubina

– akce sezony (Zlatá helma) 2004/2005: Michal Mikeska

– Nejproduktivnější hráč

Michal Mikeska

– Hokejová jednička

Aleš Hemský

– nejlepší hráč play off

Ján Lašák

– akce sezony (Zlatá helma) 2005/2006: Ján Lašák

– Sympaťák extraligy

2006/2007: -Miroslav Hlinka

-sympaťák extraligy

-Petr Sýkora

-nejlepší střelec

(zákl. části a play off)

Rekordman extraligy

Ladislav Lubina – nejvíce startů (910)

Komentáře

Přehled komentářů

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(LamaPek, 7. 2. 2024 9:07)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(LamaPek, 5. 2. 2024 20:41)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(LamaPek, 5. 2. 2024 18:22)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

(LamaPek, 5. 2. 2024 16:07)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(LamaPek, 5. 2. 2024 9:49)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(LamaPek, 5. 2. 2024 7:46)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(LamaPek, 5. 2. 2024 5:43)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(LamaPek, 5. 2. 2024 3:40)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(LamaPek, 5. 2. 2024 1:31)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(LamaPek, 4. 2. 2024 14:33)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(LamaPek, 4. 2. 2024 11:09)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(LamaPek, 4. 2. 2024 7:46)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(LamaPek, 4. 2. 2024 1:23)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

(LamaPek, 3. 2. 2024 22:13)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(LamaPek, 3. 2. 2024 20:38)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

(LamaPek, 3. 2. 2024 18:54)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(LamaPek, 3. 2. 2024 15:36)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

(LamaPek, 3. 2. 2024 10:19)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(LamaPek, 3. 2. 2024 7:17)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53

BTC PROFIT SEARCH AND MINING PHRASES

(LamaPek, 7. 2. 2024 13:08)